Gross-Up

U.S. moving expenses disbursed or reimbursed to a relocating employee or paid directly to service providers are subject to additional local, state, and federal taxes. Because of this, employers also provide gross-up in addition to the relocation expenses. Gross-up is the process of covering some or all of the additional tax liability that results from relocation-related expenses.

Prior to 2018, most relocation expenses were considered taxable income by the Internal Revenue Service (IRS). Following the signing of the historic Tax Cuts and Jobs Act on Dec 22, 2017, the select few expenses that held excludable status (primarily household goods and final travel) are now considered taxable income (along with temporary housing, cash allowances, home finding trips to name a few) with an exception for active military personnel (they still receive the exclusion).

The new tax law create change for taxpayers, as well as employer mobility programs, relocation management companies and the mobility industry in multiple ways. The full impact of the changes are yet to be understood, but much work is being done now to adjust mobility program benefits, procedures, technology, and processes that support all parties.

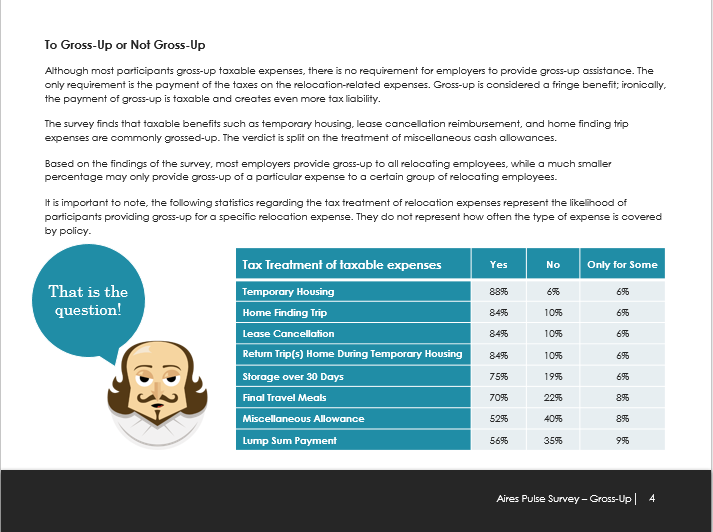

Below is a sneak peek of the Gross-up survey.